Past Workshops

The Microeconomics of Aging: Savings, Pensions, Long-Term Care, Health and Disabilities

13 - 14 - 15 September 2023

Public attendance via Zoom or in-person (limited)

This academic workshop takes place at ETH Zurich, Switzerland. It is jointly organized by the Chair of Integrative Risk Management and Economics at ETH Zurich, the ETH Risk Center, and the Rennes School of Business.

Scientific Committee:

- Prof. Antoine Bommier, Chair of Integrative Risk Management and Economics, ETH Zurich

- external page Prof. François Le Grand, Rennes School of Business

- Dr Hélène Schernberg, Executive Director, Risk Center, ETH Zurich

The workshop fosters interactive discussions through presentations that delve into the latest research, both theoretical and empirical, in the fields of savings, pensions, long-term care, health shocks, disability, and other associated areas.

Registration is now open: https://u.ethz.ch/KNAB8

You can attend the workshop on Zoom or in person. The number of seats is limited.

The event starts with a welcome address by Profs. Antoine Bommier and François Le Grand on Wednesday 13 September at 2.30 p.m. CET. The workshop closes at 12.30 p.m. on Friday 15 September.

Food and drinks are provided during the breaks, as well as lunch on Thursday 14 September.

We look forward to your participation and to exchanging ideas in the microeconomics of aging.

Change Management: How to Lead Through Transformation

Together with the MAS ETH MTEC program.

Wednesday, 25 November 2020 // from 03.00 p.m. to 07.00 p.m. CET (ONLINE via ZOOM)

Speakers:

external page Cristian Matei, former Global Head of Learning and Development at General Electric

external page Stefan Kramer, Chief Operating Officer for Risk and Compliance at Credit Suisse

external page Andreas Gutzeit, Radiologist at Hirslanden Klinik St. Anna in Lucerne and lecturer at ETH Zurich

Full programm available here.

September 2020

Future Money: Which Road?

Thursday, 3 September 2020 // from 04.00 p.m. to 07.30 p.m. CET

Online Webinar - Public Session

Recorded version available here.

This public session [Webinar] hosted by the ETH Risk Center discussed the current monetary architecture and its prospects. Due to changing preferences and technological innovations, long-established forms of money lose their appeal to the public. Various countries experience a decline in the usage of cash, and digital currencies meet increasing attention. The current monetary architecture is thus exposed to fundamental challenges and may require extensive changes.

Climate Risk and the Built Environment: Can Data make a difference?

28 October 2019

ETH Zürich, Hönggerberg, HIB Level E, Open Space 2

Full programme Download here (PDF, 3 MB)

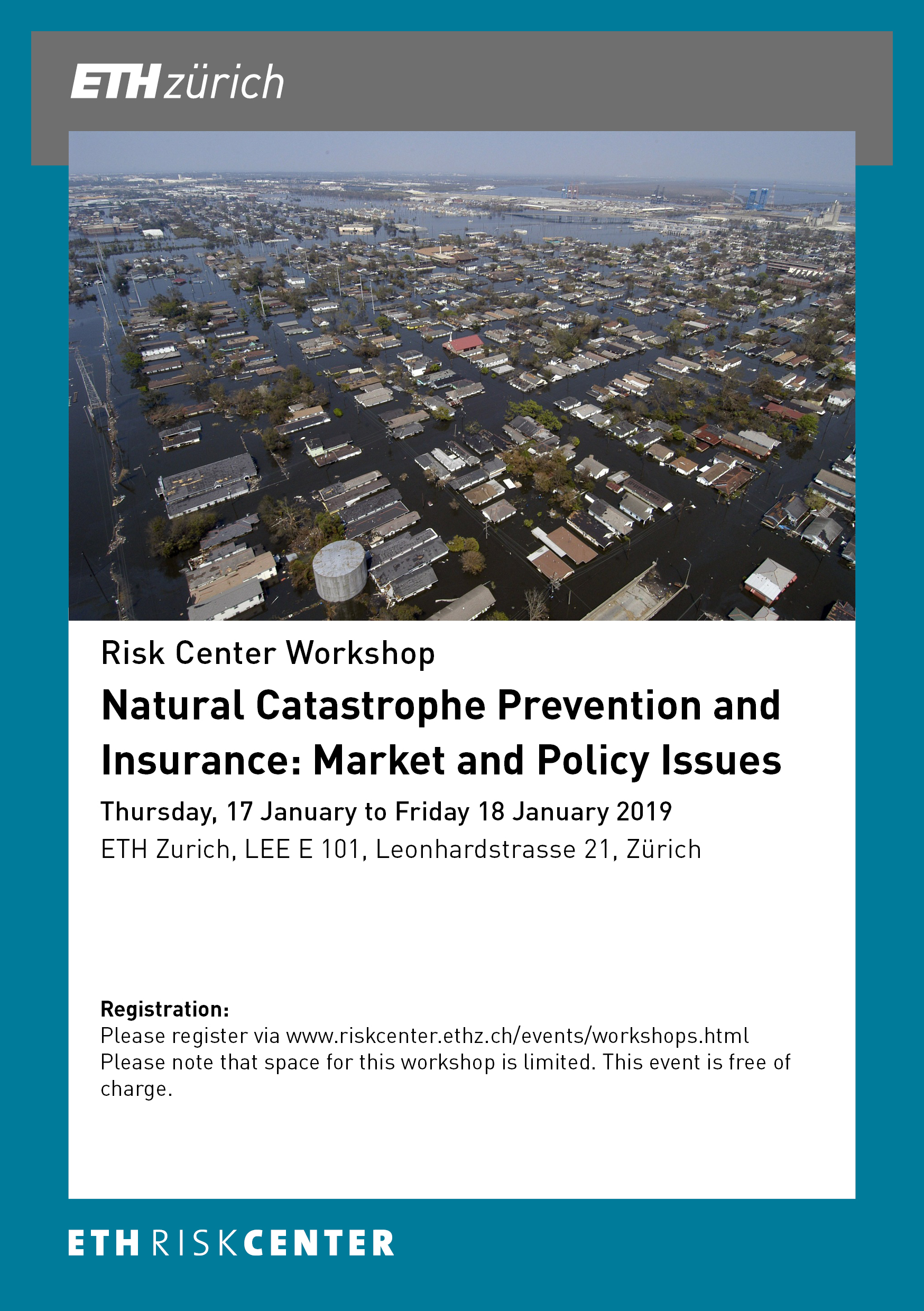

Natural Catastrophe Prevention and Insurance: Market and Policy Issues

Thursday, 17 January to Friday 18 January 2019

ETH Zurich, LEE E 101, Leonhardstrasse 21, Zürich

Full programme Download here (PDF, 1.2 MB)

Aims and Scope:

Natural catastrophes regularly bring to the forefront the same questions on the prevention and insurance of natural catastrophe risks. The tremendous and rapidly growing losses lead to speculation as to the increasing excess of risk exposure. It is also a matter of concern that insurance coverage is so low in most cases. The growing economics literature on natural catastrophe risks sheds light on the role of insurance market failures and poorly designed public policies on these issues. The workshop aims at sharing new academic knowledge on these topics from an economics point of view. Research contributions in this area are all the more crucial in that natural catastrophe risks are expected to escalate with climate change.

Guiding Questions:

- Are actual insurance markets and public policies sufficiently well designed to cover catastrophe risks and to give incentives for prevention actions?

- What type of innovations could be implemented to improve insurance coverage and risk reduction?

- Which tools could increase incentives for prevention while taking into account equity?

- How can we deal with the lack of knowledge of natural catastrophe risks?

- How could people be better informed on natural catastrophe risks?

- How could risk diversification be increased for large catastrophe risks?

- What are the connections between natural catastrophe policies and climate change policies?

Workshop Gallery

Managing Risk in Agriculture

A Symposium focused on Innovations in

Agricultural Insurance and Digitization

5 July 2018, 8.30 - 16.30, ETH Zürich

Full Programm Download here (PDF, 452 KB)

In collaboration with the ETH Risk Center and the Agricultural Economic and Policy group of Prof. Robert Finger, the WFSC organized the event “Managing Risk in Agriculture,” a symposium focused on innovations in agricultural insurance and digitization.

Pictures Workshop Agro Risk

On the evening of 05 July, more than 150 participants from different scientific disciplines and institutions as well as a large number of representatives from the insurance industry, cantonal and federal administrations, and farmers’ organizations gathered at ETH Zurich to discuss recent scientific developments in the field of agricultural risk management. The event entitled “Managing Risk in Agriculture“ was a symposium on innovations in agricultural insurance and digitization, co-organized by the World Food System Center, the ETH Risk Center, and the ETH Zurich Agricultural Economic and Policy group of Prof. Robert Finger.

Agricultural production is characterized by a variety of risks, e.g. due to volatile weather, markets but also policy conditions. Assessing and managing risks is thus of key importance for an optimal decision-making, also in agricultural production. Increasingly climate variability is further accelerating uncertainty at all stages of value chains. Recent advances in Big Data are promising to provide opportunities and technologies to enhance risk management in agricultural production using high-resolution data from satellites, open data platforms and data from agricultural machines. A risk-based decision-making incorporating these advances will involve a common understanding among up and downstream companies, policy makers as well as finance and insurance professionals.

These topics were discussed in both presentations from industry and science and a lively panel discussion, moderated by Dr. Bastian Bergmann from the ETH Risk Center. Presenters included Dr. Hans Feyen (Swiss Re), Prof. Yann de Mey (Wageningen University & Research), Prof. Joshua Woodard (Cornell University), and Prof. Finger.

Dr. Hans Feyen from SwissRe presented the Re-Insurance perspective on Digitization in agricultural insurance and especially discussed the views and roles of a (re)insurer in that respect. Dr. Feyen showed the need to overcome information asymmetries between farmers and insurance companies and identified needs for better data as well as a better use of the available data. Download Download Dr. Feyen's presentaion here (PDF, 2 MB)

Prof. Yann de Mey from Wageningen University presented insights in risk, risk management, and resilience in European agriculture. He especially presented the research vision of the Horizon 2020 project SURE-Farm (Towards SUstainable and REsilient EU FARMing systems, http://surefarmproject.eu/) that is coordinated by Wageningen University and also comprises research activities at the Agricultural Economic and Policy Group of ETH Zurich. An important conclusion drawn by Prof. De Mey was to put resilience in farming systems in a larger perspective. Resilience thinking should go beyond short-term robustness because also the adaptability and even transformability are important components of farming systems resilience. Download Download Prof. de Mey's presentation here (PDF, 3.2 MB)

Prof. Joshua Woodard from Cornell University presented recent activities related to the development of an open source, open data platform and applications for agricultural and environmental finance and insurance. The platform Ag-Analytics https://ag-analytics.org/ is an integrative tool bringing together various public datasets (e.g. on weather, soil and land use) and satellite information with farmers’ information on input use and yields. This platform creates a unique field-level database that supports farmers’ decision-making and enables novel insurance opportunities.

Prof. Finger presented the idea that farmers chose a risk management portfolio from a variety of available tools and highlighted the potential benefits of insurance solutions as part of such portfolio. New technologies and large publically available datasets (e.g. on crop phenology and weather) create massive opportunities to develop better, cheaper and more widely used insurance solutions. However, Prof. Finger also discussed the potential negative effects of the subsidization of agricultural insurances on the environment that need to be considered by policy makers. Download Download Prof. Finger's presentation here (PDF, 2.3 MB)

The WFSC, the ETH Risk Center, and the Agricultural Economic and Policy Group thank all for making this public event such an interesting discussion. Special thanks to our speakers Hans Feyen, Yann de Mey, Joshua Woodard and Robert Finger.

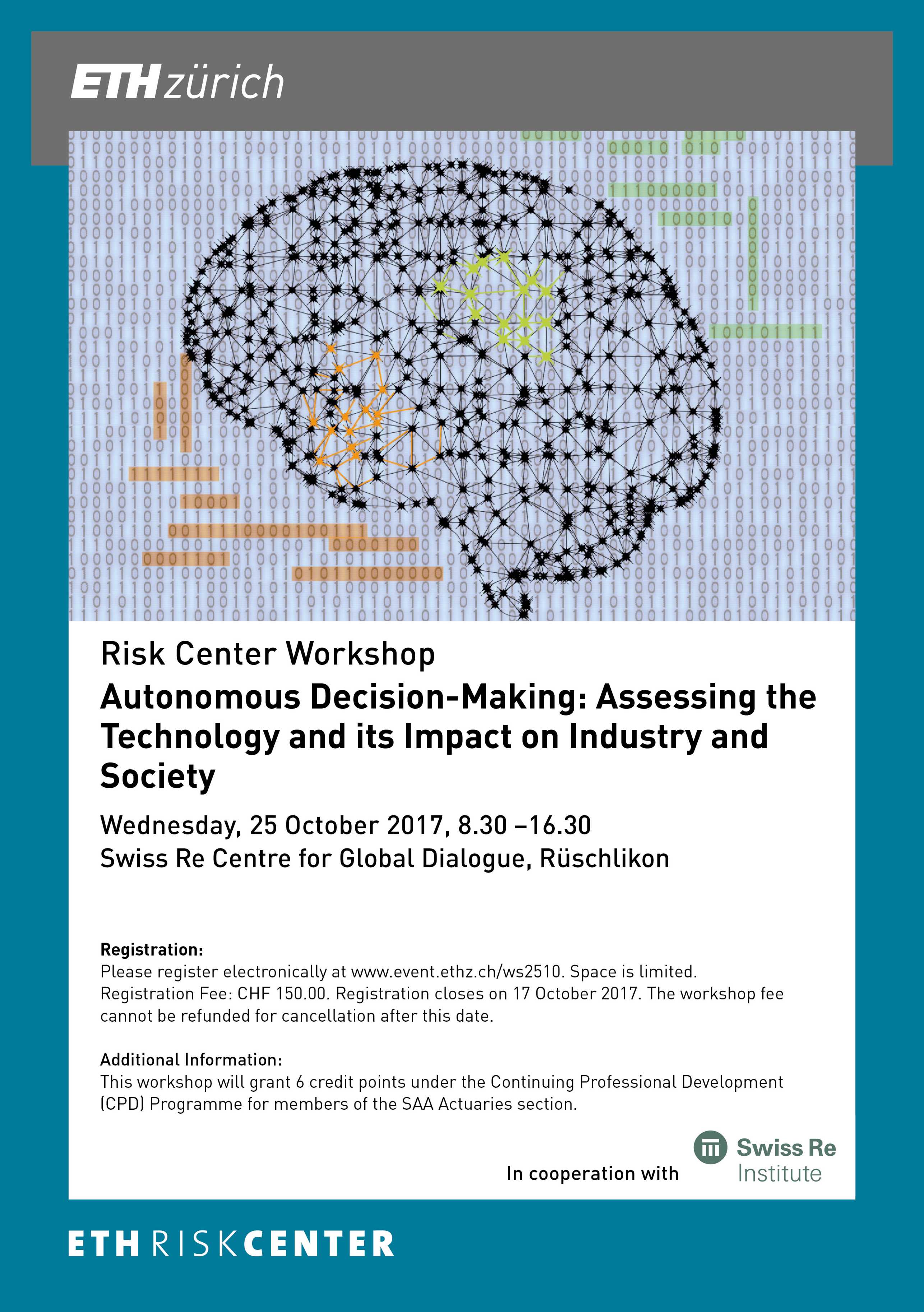

Autonomous Decision-Making: Assessing the Technology and its Impact on Industry and Society

25 October 2017, 8.30 - 16.30

Swiss Re Institute, Rüschlikon

Risk Center Workshop Autonomous Decision-Making

Please find invitation and programme Download here. (PDF, 2 MB)

Presentations Download here. (ZIP, 21.6 MB)

Links to ETH Spin-offs:

external page 1plusX - From Data to Predictions

external page DeepCode - From Code to Predictions

external page Drone Harmony - Optimal Mission Planning for Drones

external page Veezoo - Ask the Company Brain

Video glimpse external page here.

More information external page here about the Swiss Re Institute as a corporate partner of the ETH Risk Center.

Summary About the Workshop:

Do computers make better decisions? If so, what will be the impact on business, society and on ourselves? What conditions would make autonomous decision-making acceptable? At a recent workshop organized by the ETH Risk Center together with the Swiss Re Institute, leading experts from academia and industry discussed the current state of the art of machine learning technologies for autonomous decision-making, together with over a hundred participants.

“The need for more transparency” was one of the key reasons for the workshop. Transparency, not only in the technical aspects of the algorithms – this is limited up to a certain point – but also more transparency about the driving force behind the algorithms. Participants agreed that more transparency would be vital to build the level of trust needed to accept and integrate the technology, especially for autonomous decision-making. For the near future, an ideal scenario would be to have hybrid decision-making systems, for example, running computer-based systems in parallel to human systems and comparing them.

AI as "a collective weird thing"?

The first part of the event assessed the scope and limits of the technology. In his opening talk, ETH Professor Thomas Hofmann, defined intelligence as the ability to understand or to make sense and to act accordingly. Characterising intelligence as the "crown of evolution" with the ultimate goal to get more intelligence, on this journey, we, as humans might only be an intermediate product. Machine intelligence as such is not bound to mimic just human skills. Far from that, Hofmann expects that machines will not stop at the human level but will enter into new dimensions of intelligence, making use of a networked intelligence. With our knowledge of today, we may only think about AI in the future as a “collective weird thing”. In terms of computer vision, machines have already achieved forms of autonomy by perception and super human face recognition. Combining this with recent achievements in language understanding, like human voice recognition, machine reading by linking text with knowledge representation allow some form of reasoning across billions of documents. Recent developments in machine translation and more even more recently in reinforcement learning show the enormous potential lying ahead of us.

In the second talk, Prof. Thomas Hills from Warwick’s Department of Psychology showed that interactions in social media, for example, clicking, actually means “acting” and by using these platforms, or processing the information from social media, we, in turn, change our personality, too. Therefore, social information is a huge influence on our personality and the algorithms are co-evolving along these lines. This creates a feedback process which, most importantly, might also amplify our biases. Social risk amplification is one example. According to Hills, we must be aware of the fact that whenever we create data (with our biases in it), and have algorithms processing these data, the algorithm takes over our biases. When we want to build trust to using algorithms for decision-making, he pointed to the psychological fact that people want narratives for doing things. In the end, we need reasons to justify an action. Reasons are only deductible from the system if it has a certain level of transparency about itself and about the mechanisms in which it is placed.

In his talk, Prof. Christoph Hölscher, Chair of Cognitive Science from ETH Zurich added that machines today may “understand” a lot already but in most situations this understanding is very context specific and, whenever the context switches, the machine gets into trouble. In terms of human interaction and feedback processes in between, the computer also helps to understand what is going on in the human mind. Concerning the acceptance of autonomous decision systems, Hölscher pointed to the psychological fact that people want to predict, understand and be in control and do not want to be limited in their actions. He also warned of active filtering by an algorithm, e.g. refraining information on a specific person in a social network, might lead us to the conclusion that this was the willing action of the specific person. However, it might have been the algorithm who “unfriended” us from the person. He underlined that we have still problems to separate human action from computer based algorithmic action and more transparency is also necessary here.

Nico Lavarini, Chief Scientist from Expert Systems gave insights into state of the art integration of AI in insurance business processes like claims management and contract matching, as well as property and risk evaluation. Reduction of subjectivity and time efficiency, as well as cost saving are favourable outcomes of the integration in cases when the scope of the problem can be framed accordingly. However, a global quality evaluation of the success of the integration is complex, due to cognitive biases because of variable inter-rater agreements, sometimes about only 60%. Therefore, we should be aware of how much efficiency we can actually expect to achieve using technological innovations, which are ultimately based on human input.

A painful learning phase for the industry

To close the first part, Prof. Patrick Cheridito, Chair of Mathematics at ETH and Member of the Risk Center, hosted a panel discussion. Martin Schürz, the Head of Engineering Services at Swiss Re, acknowledged that the “learning phase” was painful and is still ongoing. However, the acceptance of the technology has to be increased. He underlined that more transparency would be necessary in the first place, but after a while, when a certain level of trust is reached, people will stop caring about explanation. Still more effort has to be invested in understanding the specific nature of problems, in order to make them “solvable” by the computer. Taking into account that business has only limited capacity of time and money, spending time and investing effort on trying to solve, or to frame, one single problem with an uncertain outcome is also risky in itself. Olivier Verscheure, Executive Director of the Swiss Data Science Center gave insights into their new platform to deliver the necessary infrastructure and knowledge to solve problems. Asked about future perspectives, Prof. Hills suggested we ask ourselves: What do we really need? What improves our lives, and how do we create a product to increase wellbeing?

Historical perspective – is it really different this time?

Live demonstrations of ETH Spin-offs featured in the lunch break, followed by the second part of the conference, on society and the future of work.

Daniel Castro from the Information Technology and Innovation Foundation (ITIF), Washington, framed the impact of the “algorithm economy” on industries, firms, and workers. Putting the recent debate in a historic perspective he revealed that the impact of technology on workers has been always there. Although the slogan “this time is different” is attractive now, historically, we observe a stable environment. Many times in the past, he added, people expressed their fears that automation will eliminate workers. However, none of these cases became a reality that matched those fears. In contrast, technological innovation always boosted productivity and created new tasks for millions of new jobs. As such, according to the ITIF, AI is expected to create 5 to 6 trillion dollars annually by automating knowledge work, and much of AI will boost quality, not eliminate jobs. Inevitably, some jobs will be eliminated, but most occupations, like brick masons, machinists, dental laboratory technicians, social science research scientists, firefighters, are still very difficult to automate. From a macro-perspective, Castro explained, developed countries need higher productivity to maintain the current standard of living. For example, the EU working age-to-older person ratio drops from 3.5 to 2.2 by 2040. In turn, productivity would have to increase by 13% to keep worker after-tax incomes from declining. Governments have to provide the efficient framework for allowing innovation to happen and not be hindered in the end.

An IT overdose – ensuring that technology is for human value

Prof. Sarah Spiekermann from Vienna University of Economics and Business talked about ethical system engineering. She explained that, when taking into account technological innovation, all that matters in the end is human well-being and that people should be better off through technology. Technology should not just improve business processes quantified by a questionable metric of success. According to Spiekermann, European countries see a downturn of total factor productivity despite ongoing digitalization. This is reflected at firm-level by a negative IT utility. Spiekermann asked what is our current state of well-being? Have we increased our utility since 2000? We always have a choice, a choice of engineering, and we need to be clear about what we are losing. According to Spiekermann, a value-based IT design is necessary to frame system engineering standards. Of course, outcomes in technology are hard to anticipate and the negative effects are hard to come by in advance, but an upfront assessment is the only real choice. Spiekermann explained that such an upfront assessment could be based on different moral concepts, like a utilitarian or deontological-based ethics. In addition, basic human rights also need to be incorporated in such a design standard. Finally, it is also important to put the technology into the specific context where it is used. Usually, IT companies, by providing only the technology, have no idea of the context. We need to be more context sensitive and be more transparent about the uses and drivers behind the technology.

More transparency – revealing the algorithm's driving force

In the final panel discussion, moderated by Prof. Hans Gersbach, Chair of Macroeconomics: Innovation and Policy at ETH, and a founding member of the Risk Center, posted the question of how we might use automation for public tasks. Failures of the system, like corruption, would become much more difficult using a computer based intelligent system. Nevertheless, governance requires a lot of trust, and that is still lacking for autonomous, computer-based systems. For Daniel Castro, a fully automated system is very far off. We will always have humans involved. But while he admits that the “computer world” is not be perfect, neither is the “human world”. In terms of supervision, Nina Arquint, Head Group Qualitative Risk Management at Swiss Re, stated that companies must take responsibility for themselves, or they will lose customers – the biggest asset in a business. In some sense, supervision lags always behind and, according to Arquint, the information gap between supervision and business is increasing. With that in mind, she added, supervision has no other choice than to use the technology just to keep pace.

Assessing the benefits of AI through hybrid decision-making

Prof. Hofmann admitted that to find a bias in a machine learning system is very hard but to find and eliminate a bias in an organization is also difficult. Fixing the problem might be even easier for the algorithm than to train humans to change their behaviour and eliminate a bias. We are still in a “start-up” phase – if things go well we will live in a better world. Prof. Spiekerman is more sceptical: Machines so not deliver the perfect world of an “objective” system. One also has to ask, "Who is sitting behind the machines? Big corporations?" To build up trust in the system, Hofmann suggested running both systems in parallel – as far as possible – and then compare the outcomes. This hybrid decision-making might reveal the benefits and drawbacks of each decision-making system.

Extreme Value Theory with Applications to Insurance and Finance

24 March 2017, 13.00 - 17.00

ETH Zurich, Rämistrasse 101, HG E 3

On March 24, Prof. Marie Kratz gave a workshop on Extreme Value Theory to about 150 participants ranging from banking, insurance, regulators and academia. The workshop closed with a panel discussion.

Please find slides here

Workshop on Cascade Processes: Mathematical Modeling and Applications

19 and 20 January 2017

As part of the ETH48 Research Project, the ETH Risk Center organizes a workshop that brings together experts on cascade phenomena from various disciplines. We identify commonalities and differences between methodological approaches and discuss possible interpretations in different contexts. In particular, we study economic and financial systems, shed light on epidemic spreading, and look at similarities with information cascade in social online media.

Schedule:

Thursday, 19.1.2017 - 13:00 to 18:45 hrs.

Friday, 20.1.2017 - 8:30 to 12:00 hrs.

Organizing Lead:

Dr. Rebekka Burkholz, Chair of Systems Design and Risk Center, ETH Zurich

Programme:

Please find more details Download here. (PDF, 144 KB)

Registration:

Please register via e-mail to Rebekka Burkholz (rburkholzatethz.ch) until 16 January 2017. This event is free of charge.

Confirmed Speakers:

- Stefano Battiston, Institute for Banking and Finance, University of Zurich

- Rebekka Burkholz, Chair of Systems Design and Risk Center, ETH Zurich

- Fabio Caccioli, Department of Computer Science, University College London

- Dionysios Georgiadis, ETH Singapore Center, Future Resilient Systems Programme, Singapore

- James P. Gleeson, MACSI, Department of Mathematics and Statistics, University of Limerick, Ireland

- Sergio Gomez, Departamento Enginyeria Informàtica i Matemàtiques, Universitat Rovira i Virgili, Spain

- Manuel Gomez Rodriguez, MPI-SWS, Kaiserslautern, Germany

- Jan Nagler, Computational & Theoretical Physics @ IfB & Risk Center, ETH Zurich

- Raúl Toral, Departamento de Física & Instituto de Física Interdisciplinar y Sistemas Complejos (IFISC, UIB-CSIC), Spain

- Olivia Woolley Meza, Chair of Computational Social Science, ETH Zurich

About:

Cascade processes are a widely observed phenomenon. In the course of globalization and technological advancement, systems become more interconnected and system components more dependent on the functioning of others. In particular, for socio-economic networks and financial networks, we observe an increase in coupling strength and complexity at the same time. Examples are global supply chains, but also technical systems, like power grids or the internet of things. The increasing connectivity in such systems has usually many advantages. For instance, resources can be allocated where they are needed and can thus be used more efficiently. In addition, connectivity can provide redundancy and absorb local shocks. Very often, higher connectivity is crucial for the functionality of a system. For instance, it can be necessary to cope with increased requirements in system’s performance. Power grids might need to serve an increased electricity demand and thus have to be expanded. More food for an increasing world population needs to be provided and thus transported to its destination. However, at the same time, highly connected systems are prone to cascading phenomena and can thus carry an eventually high amount of systemic risk. Incidents like the US Northeast power grid blackout of 2003 or the financial crisis in 2007/2008 have raised awareness for the downsides of increasing interdependency and complexity. Insights into such cascade phenomena support the improvement of many systems' resilience.

Mastering the Challenges of our Digital Society

Friday, 4 November 2016, 9.00 to 16.30

Zurich Development Center, Zürich

Risk Center Workshop Digital Risks

Full programme and registration details Download here. (PDF, 950 KB)

Presentations Download here. (ZIP, 99 MB)

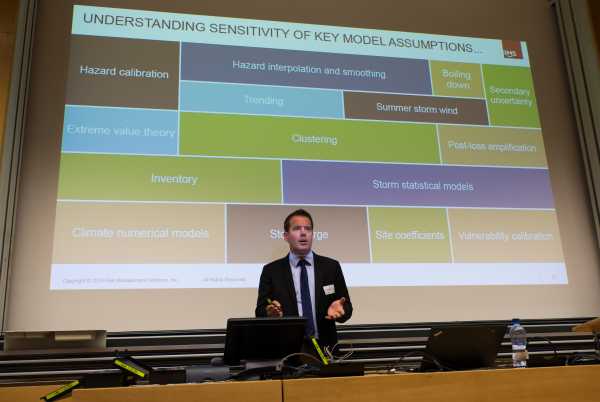

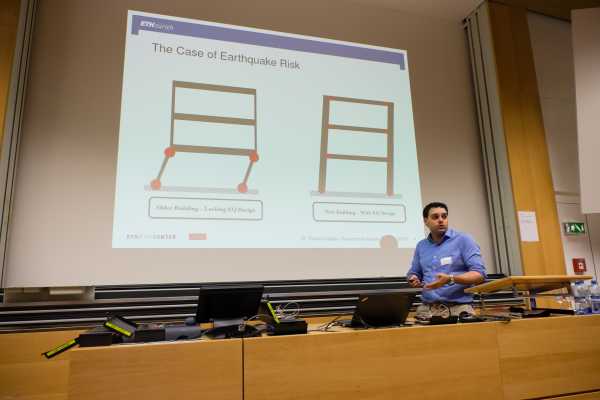

Understanding the Risks of Extreme Events: Challanges in Risk Management of Natural Catastrophes

Friday, September 2, 2016, at ETH Zurich, Main Building, D1.1

Organizing Committee

Prof. Bozidar Stojadinovic, Bastian Bergmann, Panagiotis Galanis

Download Slides (ZIP, 40.1 MB)

The workshop brought together experts from different industries, scientists, (re)insurers, governmental authorities in order to present and discuss the main challenges in modeling extreme natural events. The workshop was split into two parts:

First part: In this part natural disasters will be presented mainly from the perspective of civil protection and public safety. Leading experts from both academia and public authorities will discuss their experiences on natural disaster risk evaluation and reduction.

Second part: In this part the discussion will focus on the financial impact of natural disasters. Professionals from different insurance market participants will share their views on challenges related to quantifying the risk of natural catastrophes and how catastrophe models could assist in taking risk informed decisions to be better prepared for future events.

Risk Center Workshop Extreme Events

Conference Gallery

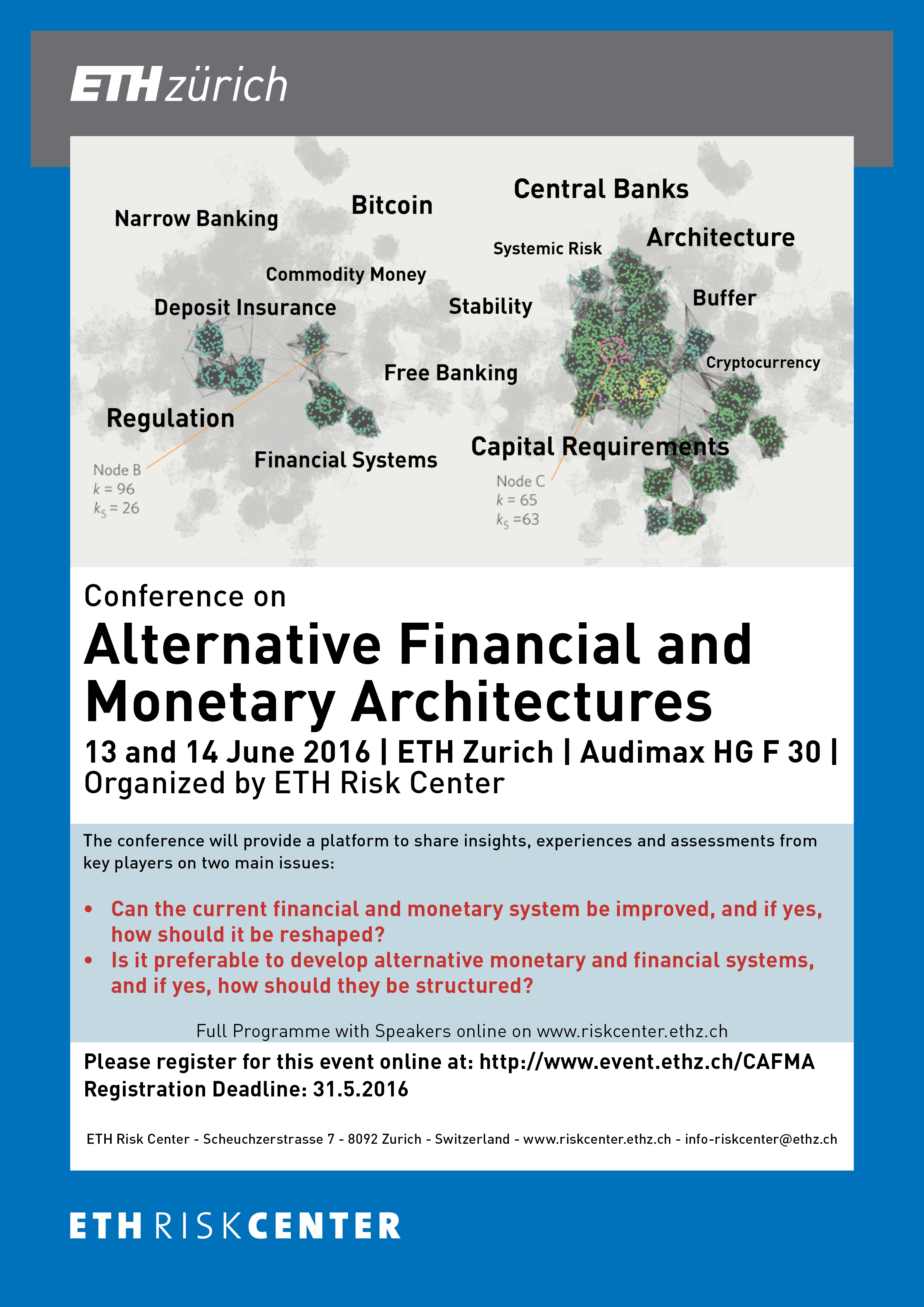

Alternative Financial and Monetary Architectures

Monday, June 13 (afternoon) and Tuesday 14 June (morning), 2016, at ETH Zurich, AudiMax, HG F30

Organizing Committee:

Hans Gersbach, Bastian Bergmann

Download Invitation and Full Programme (PDF, 477 KB)

Download Presentations/Slides (ZIP, 12.2 MB)

The conference will provide a platform to share insights, experiences and assessments from key players on two main issues:

· Can the current financial and monetary system be improved, and if yes, how should it be reshaped?

· Is it preferable to develop alternative monetary and financial systems, and if yes, how should they be structured?

Additional Information:

This course will grant 6 credit points under the Continuing Professional Development (CPD) Programme for members of the SAA’s Actuaries section.

"Policyholder Behavior in Insurance Decision Making"

September 28/29, 2015, at ETH Zurich

Download Programme here (PDF, 272 KB)

Organizing Committee:

Prof. Wanda Mimra

Prof. Antoine Bommier

Benjamin Huber (AXA Winterthur)

Supported by: AXA Research Fund Switzerland

Slides

please find them Download here (ZIP, 4.1 MB)

Impressions

Workshop: Policyholder Behavior in Insurance Decision Making

"Financial, Technological, Social and Political Bubbles"

March 26, 2015, at Prime Tower Clouds, Zurich

Organizing Committee:

Prof. Didier Sornette (Chair)

Dr. Monika Gisler

Lukas Gubler (Axpo Trading)

Download Program here (PDF, 443 KB)

Download Slides here (ZIP, 6.3 MB)

Supported by: Swisselectric/Axpo Trading

"Funding Longer Lives and Elderly Protection"

October 20-21, 2014, at Swiss Re Global Dialogue Centre, Rüschlikon

Organizing Committee:

Prof. Antoine Bommier (Chair)

Prof. Paul Embrechts

Stephan Schreckenberg (Swiss Re)

Download Program here (PDF, 50 KB)

Supported by: Swiss Re

"Vulnerability and Resilience of Supply Chains"

September 12-13, 2013, at Zurich Insurance Company, Zurich

Organizing Committee:

Prof. Dirk Helbing (Chair)

Prof. Wolfgang Kröger

Benno Keller (Zurich Insurance Company)

Download Program here (PDF, 99 KB)

Supported by: Zurich Insurance Group

"New Views on Extreme Events: Coupled Networks, Dragon Kings and Explosive Percolation"

October 25-26, 2012, at Swiss Re, Adliswil

Organizing Committee:

Prof. Hans Jürgen Herrmann (Chair)

Prof. Dirk Helbing

Prof. Didier Sornette

Download Program here (PDF, 128 KB)

Supported by: Swiss Re