Introduction to Risk Modelling and Management

A look into various aspects of modelling, dealing and managing risk across different industries, contexts and applications. Lecturers are either risk professionals from the industry or government, or academics from varying disciplines.

Description

This course walks you through the building blocks of risk modelling and management: uncertainty, vulnerability, resilience, decision-making under uncertainty, to name but a few. The course fosters a practical, real-world understanding of how models are used in the decision-making process in business.

Topics range from enterprise risk management to natural catastrophes, from climate risk to energy market risk, from risk engineering to financial risks, operational risk, cyber risk and more. Note that our panel of speakers varies every year. Therefore, not all risks are covered on any given year.

Format

The course is organised in three blocks:

- Elements of Risk Modelling and Analysis: Probability, Uncertainty, Vulnerability...

- Elements of Risk Management: Enterprise Risk Management, Project Risk Management, decision-making under uncertainty...

- Applications to various areas

Each session is taught by a different guest, from ETH faculty to risk professionals of various backgrounds.

Learning Objectives

After taking this course, you are able to

- Reflect on risk models, their uses and limits.

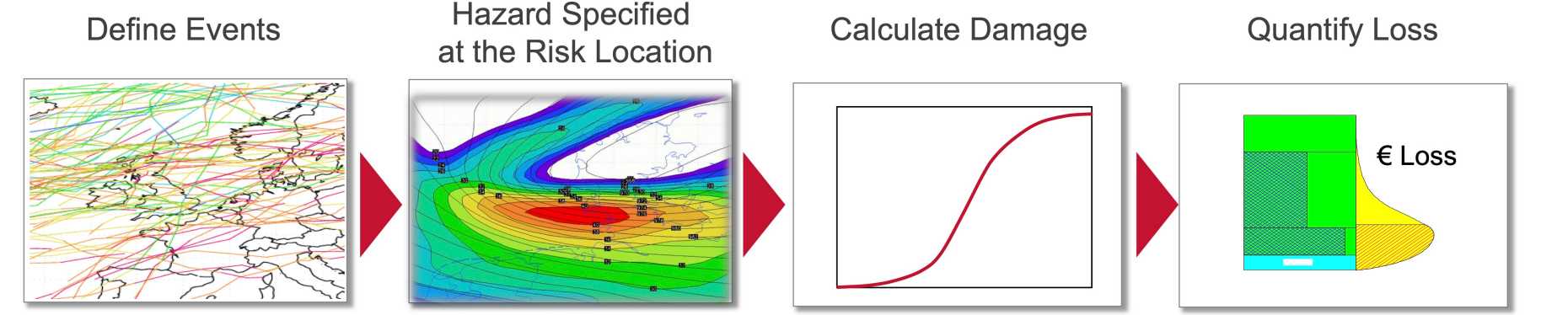

Identify and formulate a risk analysis problem with quantitative methods in a particular field (e.g. natural catastrophes).

- Understand what is expected of 21st century risk managers in various contexts.

- Describe the qualities that an efficient risk manager must possess to excel in their role.

Required competences

Preliminary knowledge or experience with risk modelling or management is not necessary. A quantitative background is highly recommended (i.e. you are comfortable with mathematics, probability, statistics...).

Who, when, what?

The course (3 ETCS) runs in the Spring Semester in the D-MTEC curriculum (MSc and MAS) and the Master in Quantitative Finance Program. We welcome all ETH students.

Non-MTEC students: Please consult the Study Office of your department to ensure you can earn the credits from the course.

Coordinator

- Dr. Hélène Schernberg, ETH Risk Center

2022 Speakers

- Dr. Sandra Andraszewicz, Senior Researcher, Chair of Cognitive Science, ETH Risk Center

- Dr. Bastian Bergmann, Coordinator of Studies MAS, D-MTEC

- Dr. Jeffrey Bohn, Chief Strategy Officer (CSO), One Concern

- Prof. David Bresch, Chair of Climate Risk, Risk Center, D-USYS

- Dr. Michel Dacorogna, Prime Re Solutions

- Prof. em. Paul Embrechts, RiskLab and Risk Center, D-MATH

- Dr. Jennifer Firmenich, elsener+partner AG

- Dr. Stefan Frei, Senior Information Security Officer, SIX Digital Exchange (SDX)

- Emilio Granados Franco, Head of Global Risks and Geopolitical Agenda, World Economic Forum

- Dr. Lukas Gubler, Chief Risk Officer, Axpo Trading

- Dr. Laurent Marescot, Senior Director, RMS Data Solutions

- Dr. Robert Perich, Vice President for Finance and Controlling, ETH

- Dr. Hélène Schernberg, Executive Director, ETH Risk Center

Past Speakers

- Dr. Diethelm Boese, Vice President, Head of New Product Delivery, ABB

- Dr. Stefan Brem, Head Risk and Research Coordination, Swiss Federal Office for Civil Protection (BABS)

- Prof. Roger Cooke, Ressources for the Future Institute, Washington DC

- Dr. Roland Goetschmann, Advisor Financial Stability, Swiss National Bank

- Prof. Anastasia Kartasheva, University of St Gallen

- Prof. Marie Kratz, ESSEC Paris

- Dr. Katja Pluto, Chief Risk Officer EMEA, Zurich Insurance

- Iwan Stalder, Head of Accumulation Management, Group Underwriting Excellence, Zurich Insurance

- Patricio Verdieri, Head of Enterprise Risk Management, Group Risk Management, Zurich Insurance

- Prof. Ueli Weidmann, Vice-President for Infrastructure, ETH